Bonds in a Nutshell

- upinvestmentclub

- May 31, 2021

- 5 min read

By Jerilyn Camila, William Clemente, Dawn Deazeta, Janelle Maluping & Anthony Bugaoan

Bonds are important in our lives when making connections with other people. We thrive from it, as it gives us a sense of purpose and direction. But do you know that investing in bonds can also make an impact in our lives as beginning investors? It can become your key to making it big as an investor, little by little!

So, what is a bond? It is an asset class under a fixed income instrument. Unlike in stocks, an investor’s income can vary, depending on the price of the stock at a certain period of time. When an individual invests in bonds, the bond issuer becomes a debtor obliged to pay the individual (lender or bondholder). Bondholders, also known as the debtholder or credit holder, receive returns primarily through fixed interest payments, and sometimes, capital appreciation when bought below the face value in the secondary market.

Bonds can be issued by different entities including companies, and governments to fund projects well beyond the capacity of banking institutions.

In the hierarchy of investment safety, bonds are known to be more secure compared to the stocks due to it having priority in case of liquidation. When a corporate entity liquidates, creditors such as bondholders are prioritized in getting paid. Thus, there is relatively less risk in investing in bonds compared to other assets such as stocks.

The following terms are important terminologies to take note when investing:

Face Value- This is the amount of money the bondholder will receive on the maturity date.

Maturity Date- The date when the bond matures and the principal amount, the face value, is returned to the bondholders.

Coupon dates- This is the schedule of interest payments.

Coupon rate- This is the interest rate the issuer will pay. The actual amount paid will be based on the face value of the bond. For example, a 10% rate on a bond with a 1000 peso face value will yield 100 pesos annually.

Issue price- This is the price at which the bonds were sold to the investors.

Credit Rating- This is an opinion made by an independent consultant on the credit quality of a bond based on an assessment of the financial position of the issuer.

BONDS IN THE PHILIPPINES

The local currency bond market of the Philippines increased by 5.3% on a quarterly basis and 28.9% on a yearly basis, reaching PHP8,567.7 billion (USD178.4 billion) at the end of December 2020.

In the fourth quarter of 2020, government bonds outstanding amounted to PHP6,955.5 billion, growing by 7.0% quarter-on-quarter (q-o-q). On the contrary, outstanding corporate bonds decreased by 1.3% q-o-q to PHP1,612.1 billion due to debt maturities and declining issuance in Q4 2020 compared with the previous quarter. Corporate bond issuance totaled PHP59 billion in Q4 2020, down 53.3% q-o-q.

China Bank led the debt sales during the quarter with a PHP15 billion single bond issuance. Government and corporate bonds comprised 81.2% and 18.8%, respectively, of the local bond market at the end of 2020. This only indicates that despite the coronavirus pandemic which hampered the country’s economic growth since the second quarter of 2020, the growth of bonds remained relatively strong for the succeeding quarters.

Trading Volume in the Philippines

As for the market liquidity, trading volume is an indicator of the USD value of local currency government and corporate bonds transacted in the secondary markets. In case the outstanding stock is growing at a rapid rate, the turnover ratio can provide a better measure of trading activity and market liquidity. The turnover ratio indicates the frequency at which outstanding issues have been traded in the market. The figures below show the trading activity and market liquidity of the bonds market in the Philippines as of 2020.

HOW TO INVEST IN BONDS IN THE PHILIPPINES? To invest in bonds, most banks and other financial institutions require valid identification cards, tax identification number or TIN, minimum initial investment ranging from PHP5,000 to 50,000, and bank account information.

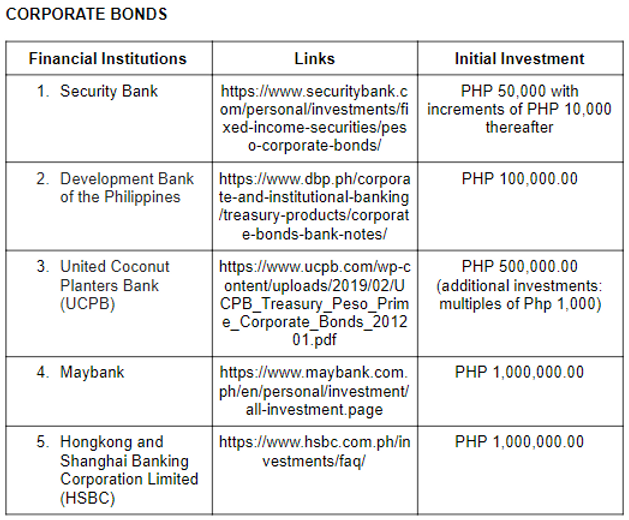

The minimum initial investment is based on what type of bond you want to invest in and on the offering institution. Treasury bills minimum initial investment requirements can range from PHP10,000 to 1,000,000. Corporate bonds range from PHP50,000 to 1,000,000.

On the other hand, investors can buy retail treasury bonds for a minimum of PHP5,000 to 500,000.

WHERE TO INVEST

The Philippines’ Bureau of Treasury (BTr) offers government securities such as treasury bills and treasury bonds to the public. The Bureau of Treasury releases the schedules of these offerings which are available on their website: www.treasury.gov.ph. There are several options available for investors when it comes to the amount, duration and possible promos and discounts.

Aside from BTr, interested investors may also purchase bonds from the other financial institutions such as Security Bank, Bank of Commerce, East West Bank, Development Bank of the Philippines, and Unionbank.

BONDS.PH

Unionbank operates a bond distribution platform called Bonds.PH. This application is free of charge when you download from Google Play Store or App Store.

It can even be accessed 24/7 globally. Bonds.PH allows any individual aged 18 and above to use it. It also does not require the user to have a bank account. Cashing in with Bonds.PH is easy because you may use your bank account, debit card, or electronic wallets like Gcash and Paymaya.

After downloading the application, users can create their accounts. Clients can sign-up by following the steps indicated in the mobile application. After filling up necessary details, individuals should verify their email address. Once done, users should undergo the customer identification and verification process so that they can have full access to Bonds.PH.

Bonds.PH made purchasing bonds simple and trouble-free. After cashing-in, users can go to ‘Bonds Available’ and place their orders. The mobile application also lets users place in multiple orders as long as they have enough cash balance. Furthermore, customers can also sell their investment through the application by making a sell order.

When a user successfully sells his/her investment, he/she can cash out by using InstaPay, PesoNet, or other electronic money wallets. However, as of this writing, Bonds.PH is currently not available for use.

CONCLUSION

Investing in bonds can be an attractive option especially for investors whose risk appetite is moderate and who are generally passive. Due to its nature as a debt instrument for bond issuers, investors in bonds (bondholders) are prioritized in case a corporate entity liquidates. In the Philippines, the bond market is strong, providing various options and opportunities for prospective investors. For small amounts, investing in treasury bonds is an option. It has the lowest risk among the other bonds since it is offered by the government. For larger amounts, investing in bonds in reputable financial institutions is also recommended. However, some banks like UnionBank offer a more affordable option for potential investors through Bonds.PH, downloadable in mobile phones.

References:

Asian Development Bank. (n.d.). Philippines. AsianBondsOnline - Philippines. Retrieved May 23, 2021, from https://asianbondsonline.adb.org/economy/?economy=PH

Bonds.PH. (n.d.). Frequently Asked Questions. Bonds.PH. https://bonds.ph/#:~:text=Help%20the%20country%20when%20you,you%20are%20in%20the%20world.

Bureau of Treasury. (n.d.). www.treasury.gov.ph

Bureau of Treasury. (2021, February 9). Bonds.PH Mobile App by Union Bank of the Philippines (“UnionBank”). https://www.treasury.gov.ph/wp-content/uploads/2021/02/RTB-25-FAQs.pdf

Pesolab. (2020, September 1). How to start investing in Philippine treasury bills. https://pesolab.com/how-to-start-investing-in-philippine-treasury-bills/

Pesolab. (2020, September 1). Investing in Philippine bonds: A beginner’s guide. Pesolab. https://pesolab.com/investing-in-philippine-bonds-a-beginners-guide/#How_can_you_invest_in_Philippine_bonds

Pineda, A. (n.d.). How to Invest in Bonds in the Philippines. Grit PH. https://grit.ph/bonds/

Comments