Economics And Investing

- upinvestmentclub

- Dec 4, 2021

- 6 min read

Updated: Dec 17, 2022

By Japhet Paul L. Falcutila, Gabriel Angelo Abuel, Mariel Denise Gapuz, and

Justin Tuazon

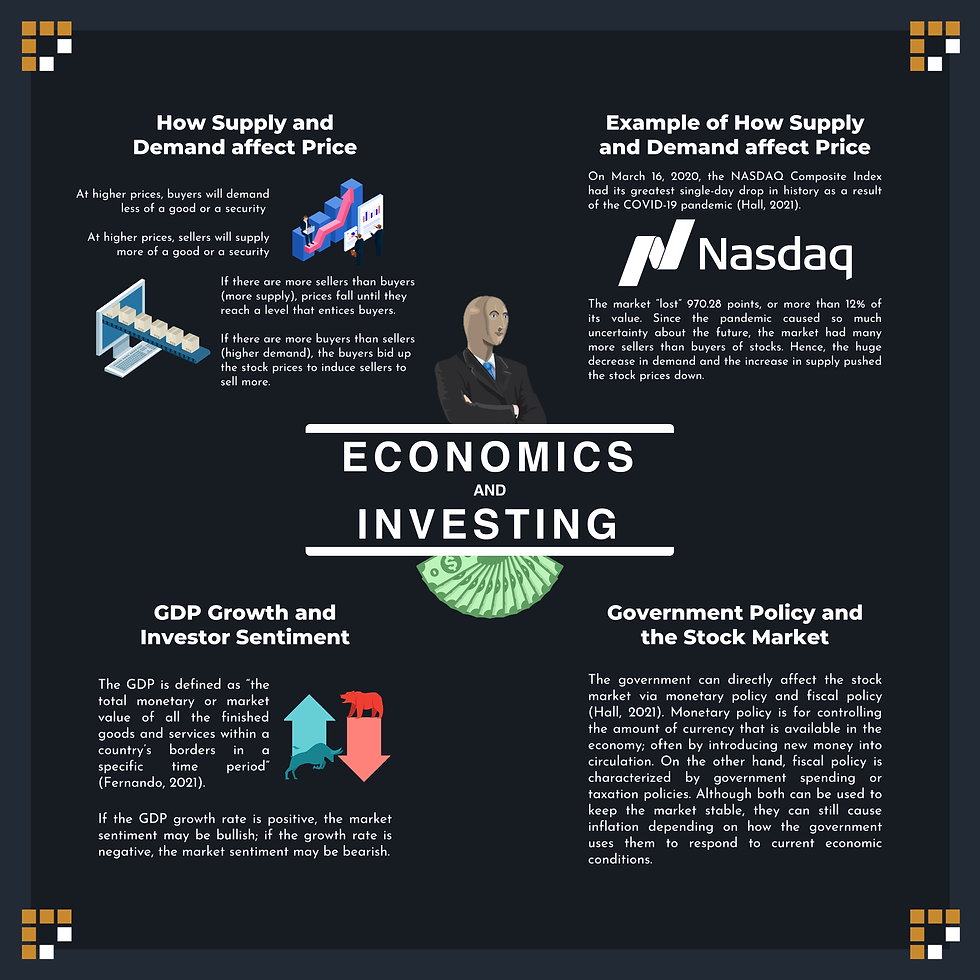

In this article, we will be focusing on three ways that economics and investing are related: how supply and demand affect prices, how a country’s GDP growth affects investor sentiment, and how government policies affect the stock market.

Supply and Demand

The law of supply and demand is a fundamental economic theory that explains how demand and supply influence the pricing of products and services. It also describes the relationship between a product’s availability and desire.

In the financial markets, supply and demand determine the pricing of stocks and other securities.

Basic Rules of Supply and Demand:

1. At higher prices, buyers will demand less of a good or a security

Buyers usually like to purchase goods and services at a low price. When the price of a good becomes higher, buyers will purchase less of the good since the opportunity cost of purchasing the good also goes up.

2. At higher prices, sellers will supply more of a good or a security

Sellers supply more of a good or security at a higher price because the higher selling price offsets the increasing opportunity cost of each extra unit sold.

3. If there are more buyers than sellers (higher demand), the buyers bid up the stock

prices to induce sellers to sell more.

If the demand for a certain stock is higher than the supply, the buyers will push the stock prices up until it reaches the equilibrium price and quantity. Sellers will be interested to sell more of the stocks to meet the high demand.

4. If there are more sellers than buyers (more supply), prices fall until they reach a level

that entices buyers.

If the supply for a certain stock is higher than the demand, sellers will push the stock prices down as they sell stocks to a few buyers. The selloff of the stock will stop when the supply and demand reached an equilibrium price and quantity.

Factors that influence the demand and supply of stocks:

Economic Data

Interest Rates

Corporate Results

Issuing of New Shares

Market Dynamics

Economic Conditions

Changes to Economic Policy

On March 16, 2020, the NASDAQ Composite Index had its greatest single-day drop in history as a result of the COVID-19 pandemic (Hall, 2021). The market “lost” 970.28 points, or more than 12% of its value. Since the pandemic caused so much uncertainty about the future, the market had many more sellers than buyers of stocks. Hence, the huge decrease in demand and the increase in supply pushed the stock prices down.

GDP Growth and Investor Sentiment

What is Gross Domestic Product (GDP)

There are many ways to gauge a country’s economic performance. One of the most common ways to do so is by computing the Gross Domestic Product (GDP) of the country (Kramer, 2021). As explained by Fernando (2021), the GDP is defined as “the total monetary or market value of all the finished goods and services within a country’s borders in a specific time period” (para. 1). By looking at the GDP, one can have an idea on how large the economy of a country is at the specified period of time (Fernando, 2021). According to Fernando (2021), one can also evaluate the growth rate of an economy by examining the country’s GDP figures from different periods of time.

Importance of GDP to Economists and Investors

The growth rate of GDP may be positive or negative. A positive GDP growth rate is an indicator of a growing economy while a negative GDP growth rate may indicate the onset of a recession. As such, when GDP growth rate is positive, market sentiments may be bullish which could mean that investors are buying and stock prices are going up. Conversely, when GDP growth rate is negative, market sentiments may be bearish wherein investors are selling and stock prices are going down.

Philippines’ GDP amidst the Pandemic

When COVID19 initially hit the Philippines, the economy declined by 9.6% in 2020. GDP growth rate went down as a number of working Filipinos were laid off, tourism was halted, and consumer confidence declined as lockdowns were implemented in the country. This decline in the country’s economy may have given investors a negative outlook and may have raised questions such as whether the economy can bounce back.

Simply put, Philippine stock prices dropped as businesses in the country either limited or completely halted operations when hard lockdowns were imposed. The Philippine Stock Exchange index (PSEi) dropped to 4,000 levels when the Luzon-wide lockdown was implemented in March 2020. This of course affected market sentiment such that it made it overly bearish, as charts went red for the most part of 2020.

Government Policy and the Stock Market

There has always been a debate about how much the government should influence the markets. Some say that the government should never intervene in the market while some in the other extreme say that the government should completely control the market. Most opinions are somewhere in the middle. In whatever case, there are two main ways the government can directly affect the stock market: monetary policy and fiscal policy (Hall, 2021).

Monetary Policy

Monetary policy is defined as the control of the amount of currency that is available for use in the economy: this is primarily done by introducing new money into circulation. Monetary policy is primarily the responsibility of the country or state’s central bank (Hall, 2021). To simplify, if a central bank decides to increase the money supply higher than the growth rate of a state, this will cause inflation. Moderate inflation can be good, depending on what the central bank wants to do, however if there is too much inflation, it may snowball into hyperinflation and this will plummet the value of the currency (Brock 2021).

Arguably, the most famous example of hyperinflation is the hyperinflation crisis that happened in Germany during 1923. After World War 1 ended in 1918, the German government was forced to pay the Allies a huge amount of reparations. For the meantime this caused inflation in Germany, but it was still manageable. In 1922, the German government missed a payment, and in response, allied forces occupied the German industrial heartland. The German government sought to pay both the allies and the German workers who would not work due to the occupation. Seeing no other choice, they decided to inflate their currency by printing a lot more money to pay both parties. This caused the price of the German Mark to plummet, which in return made the price of goods skyrocket. In the worst months of the crisis in 1923, a loaf of bread cost 200 million marks, even though it only cost 250 marks a few months earlier (BBC).

Fiscal Policy

Fiscal policies are defined as the use of government spending and/or taxation policies to influence the economy (CFA Institute, 2021). There are many tools that the government can use to enforce their fiscal policy, but one of the most important is the use of interest rates (Hayes, 2021). Interest rates are essentially the cost of borrowing money. This means when interest rates are low, borrowing money will be cheaper. This will cause more money to be borrowed and spent in the economy. However, if interest rates are cut too much, it will cause inflation to arise (Seabury, 2021).

A recent example of the misuse of interest rates is the recent nosedive of the value of the Turkish Lira in 2021. President Erdogan of Turkey claimed that the reason for inflation and the rising prices of goods was due to high interest rates, contrary to conventional economic teachings that high interest rates will drive down prices. Because of this, President Erdogan ordered the central bank of Turkey to cut interest rates, which caused inflation rates to increase dramatically, and in turn, plunge the value of the Turkish Lira. This caused many Turkish citizens to exchange their money to foriegn currencies in order to protect themselves from the soaring inflation (Associated Press, 2021).

References

Asian Development Bank. (2021, April 28). Philippine Economy Seen Recovering in 2021, with

Stronger Growth in 2022 — ADB. Retrieved from https://www.adb.org/news/philippine-economy-seen-recovering-2021-stronger-growth-2022-adb

Associated Press (April 12, 2021). Why is the Turkish lira crashing and what impact is the

currency crisis having in Turkey?. Euronews. Retrieved December 6, 2021, from https://www.euronews.com/next/2021/12/04/why-is-the-turkish-lira-crashing-and-what-will-be-the-impact-of-turkey-s-currency-crisis

BBC, (n.d.) The Weimar Republic 1918-1929: The hyperinflation crisis of 1923. BBC. Retrieved

December 6, 2021, from https://www.bbc.co.uk/bitesize/guides/z9y64j6/revision/5

Brock, T. (August 29, 2021). Monetary Policy. Investopedia. Retrieved December 6, 2021,

CFA Institute (2021) Fiscal and Monetary Policy. CFA Institute. Retrieved December 6, 2021,

Fernando, J. (2021, September 8). Gross domestic product (GDP). Investopedia. Retrieved

December 6, 2021, from https://www.investopedia.com/terms/g/gdp.asp

Hall, M. (2021, December 6). What are the key factors that cause the market to go up and

down? Investopedia. Retrieved December 6, 2021, from https://www.investopedia.com/ask/answers/100314/what-are-key-factors-cause-market-go-and-down.asp

Hall, M. (October, 7, 2021). Government’s Influence on Markets. Investopedia. Retrieved

December 6, 2021, from https://www.investopedia.com/articles/economics/11/how-governments-influence-markets.asp

Hayes, A. (October 21, 2021). FIscal Policy. Investopedia. Retrieved December 6, 2021, from

Kramer, L. (2021, April 25). What is GDP and why is it so important to economists and

investors? Investopedia. Retrieved December 6, 2021, from https://www.investopedia.com/ask/answers/what-is-gdp-why-its-important-to-economists-investors/

Kramer, L. (2021, December 1). How does the law of Supply and demand affect prices?

Investopedia. Retrieved December 6, 2021, from https://www.investopedia.com/ask/answers/033115/how-does-law-supply-and-demand-affect-prices.asp

Macaraeg, P. (2020, June 29). Coronavirus crash: Pandemic pushes stock market down in

Duterte’s 4th year. Rappler. Retrieved from https://www.rappler.com/business/264953-coronavirus-pandemic-pushes-stock-market-down-duterte-4th-year/

The Investopedia Team. (2021, October 5). How does the law of Supply and demand affect

the stock market? Investopedia. Retrieved December 6, 2021, from https://www.investopedia.com/ask/answers/040215/how-does-law-supply-and-demand-affect-stock-market.asp

Comments