NON-FUNGIBLE TOKENS, AN OVERVIEW

- upinvestmentclub

- Oct 30, 2021

- 7 min read

Updated: Jan 25, 2022

By Mariel Denise Gapuz, Jerilyn Shaine Camila, Gabriel Angelo Abuel & Pierre Saldajeno

Imagine you are shopping online and you just placed an order for a lovely leather bound journal. The shop probably has hundreds of that leather bound journal in their inventory and they will be sending you a random one from that pile. It doesn't matter which leather bound journal it is as long as it matches your order. At this point, that leather bound journal is replaceable. Fast forward a couple of years later; you have filled the leather bound journal with your important notes, random musings, and awesome ideas. That journal is now irreplaceable because it is unique; there is no other journal in the world that has the exact same contents of your journal.

The concept of Non-Fungible Tokens or NFTs is similar to the leather bound journal scenario above. We may all have one, but each of them is unique. But still, what exactly is an NFT? Simply put, an NFT is a digital representation of an object, whether that object is tangible like paintings and sculptures, or intangible like videos and in-game items. Its uniqueness also implies that only one person can own an NFT at any given point of time.

To understand the concept of NFTs better, we look at the meaning of the word "non-fungible". According to Merriam-Webster, "fungible" is an adjective meaning "being something of such a nature that one part or quantity may be replaced by another equal part or quantity in paying a debt or settling an account". Looking at this definition, it may still be unclear to you what it means to be "non-fungible". For simplicity’s sake, we could focus on the keyword "replaced". Something is non-fungible if it cannot be replaced; much like our leather bound journal.

In addition, we look at the word "token" in NFT. To reiterate, NFTs are simple digital representations. An object is represented as a digital token which can then be recorded in the blockchain, where NFT transactions happen. This tokenization allows objects to be authenticated or have a certificate of ownership which in turn means it becomes trackable and tradeable. Keep reading to learn how these non-fungible tokens are created.

HOW IS IT FORMED?

Have you heard of Bitcoin? Ethereum? Dogecoin? These are all examples of cryptocurrencies, which Investopedia defines as "digital or virtual currency". In other words, they exist only on our computers or more accurately, on blockchains. Similarly, NFTs are programmed to exist on blockchains. They are most commonly found on the Ethereum network, but more on this later.

As of writing, digital items are the most common objects to be "minted" or tokenized as NFTs. On a high level overview, the minting process is composed of 3 main parts: (1) creating a new block, (2) validating object information, and (3) recording the information on the blockchain. So how does one perform this process? Well, there are now various sites that allow you to mint NFTs from digital objects by simply uploading them and providing the information. Some of said sites include but are not limited to: Rarible.com, Mintable.app, and OpenSea.io. You can check out each of these sites' minting process.

This minting process is also applicable to physical objects; even though it may not be as straightforward as minting digital objects. The token will still serve as a digital certificate of ownership which is easily verified on the blockchain.

HOW DO I INVEST IN NFTs?

As mentioned during our previous FinBit, NFTs can be bought on online marketing platforms such as Rarible, Mintable and OpenSea. Those are only examples of online marketing platforms for digital assets. NFTs are also available through crypto games such as Axie Infinity, Decentraland and The Six Dragons. Check out our previous FinLit for more information on crypto games!

Investing in NFTs is fairly easy. However, you need a basic knowledge of Ethereum, a popular blockchain platform used for NFTs. The currency used in Ethereum is also known as Ether, which can be stored in your Metamask wallet (an Ethereum wallet). Metamask is available on Google Chrome store as a browser extension. Your NFTs purchases will be converted into Ether, and these amounts will reflect on your Metamask wallet.

Meanwhile, buying an Ether coin is a risk to undertake. As of this writing, 0.1 Ether is equivalent to PhP 21,394.52. This conversion is very volatile and susceptible to quick changes, just like other cryptocurrencies. Ether coins can be bought using popular platforms such as Binance, FTX, Coinbase, Crypto.com and Kraken. You can buy them anytime, unlike the assets in the stock market, since cryptocurrencies are not regulated by any government. Thus, they are also not subject to rules or laws. This characteristic of a cryptocurrency makes it very accessible, but at the same time, risky.

EXAMPLES OF NFTs

1. Side-eyeing Chloe. Who doesn’t know this meme?

2. Twitter CEO Jack Dorsey’s first Tweet

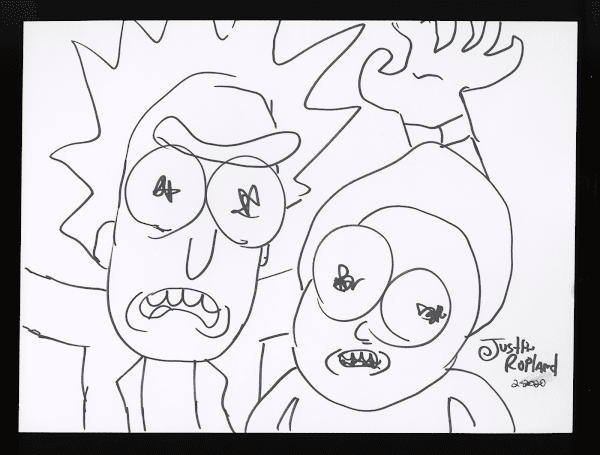

3. The First Ever Edition of Rick and Morty

4. Nyan Cat. Cutie, right?

5. 52 minutes of audio flatulence recording (yes, fart!) by Alex Ramírez-Mallis and his friends, with a starting auction price of $85. It was bought for $420 = 0.24 Ether at that time.

HOW CAN I EARN MONEY FROM NFTs?

Investors and users can earn money from NFTs in several ways, First, individuals can engage in trading NFTs. Individuals can profit by trading NFTs by buying wisely and selling them at a profit. Taking advantage of the price fluctuations of the token prices can give users a substantial amount of profit. However, losses are also part of the equation. Hence, individuals should do their own research, buy wisely, and sell them at a profit to prevent incurring huge losses.

Second, individuals can earn money from NFT gaming. Just like crypto games, individuals can earn money by playing NFT games. Individuals can buy and trade in-game items as NFTs in blockchain-based games. Check out our FinLit on Cryptocurrency Games.

Third, individuals can profit by staking NFTs. Staking is the practice of holding digital assets in the form of a “stake” and assigning them to people who are prepared to maintain their upkeep. In exchange, individuals can receive a portion of the reward.

Lastly, individuals can invest in NFT startups. Investing with NFT startups is similar to investing in stocks and other securities. Tokens can increase in value over time, which is favorable to investors. The price appreciation of tokens can give investors a substantial amount of profit just like in some stocks and cryptocurrencies. Hence, there are multiple ways to gain profit from NFTs.

NFTs IN THE PHILIPPINES

In the Philippines, the blockchain community is expanding. It continues to become more popular with investors who are seeking alternatives to the mainstream markets. While the number of NFT users is growing at a breakneck pace, the legal and regulatory treatment of the technology is stuck in limbo. New legislations on cryptocurrency and NFTs have yet to emerge in most jurisdictions, forcing regulators to depend on existing securities regulations to assess if the government should interfere to protect investor rights through the Securities and Exchange Commission (SEC).

The growth of Axie Infinity among e-games in the Philippines generated questions about NFT regulations. As of now, the Bangko Sentral ng Pilipinas (BSP) has only issued regulations concerning the licensing and regulation of Virtual Currency Exchanges. While the BSP has issued a definition of virtual assets that may be regarded to cover NFTs, Virtual Currency Exchanges are generally only authorized to trade with the top decentralized virtual assets by market cap and volume as conversion pairings for fiat. As a result, this does not apply to NFT regulation, which is more akin to tradable assets than payment instruments.

On the other hand, the Bureau of Internal Revenue (BIR) says that all income earned by Filipinos, regardless of source, is subject to taxation unless specifically provided by law. The taxability of a transaction involving NFTs would be greatly dependent on the activity(ies) conducted. It may be recognized as income for players or scholars and subject to graduated income tax rates. As a result, if the player’s or scholar’s yearly income does not exceed P250,000, the income is not subjected to income tax. If the annual income exceeds P250,000, the income is subject to graduated income tax rates.

To summarize, NFTs have gained a lot of traction and interest in the Philippines. However, it is important for investors and NFT users to understand the current laws and regulations that should be considered while dealing with these new asset classes. These regulations serve as protection for investors and users of their time and money.

Conclusion: What’s the Future like with NFTs?

To recap, we have learned that non-fungible tokens or NFTs serve as digital certificates of ownership of tangible and intangible objects. It is possible to profit from NFT trading, investing, gaming, and staking. For now, you may think that the value of NFTs comes from the hype of the objects they represent. It would seem like people are buying NFTs for bragging rights of owning a popular piece of digital media. But if we look beyond the object and instead focus on the NFT transactions, we could see how the blockchain technology was used to authenticate, verify, and transfer ownership rights. As of now, NFT is mostly used to represent pop media, but imagine if we use NFT as our certificate of ownership for all our assets like houses, lots, and cars. It could potentially reduce paperwork and fraud, becoming a more secure mode of transaction!

References:

Campbell, C. (2021, July 26). The NFT marketplace: How to buy, sell and create NFTs. https://www.nerdwallet.com/uk/investing/how-to-buy-nft/#where-to-buy-nfts

Clark, M. (2021, August 18). NFTs, explained. https://www.theverge.com/22310188/nft-explainer-what-is-blockchain-crypto-art-faq

Conti, R. & Schmidt, J. (2021, March 14). What You Need To Know About Non-Fungible Tokens (NFTs). https://www.forbes.com/advisor/investing/nft-non-fungible-token/

ET Online. (2021, September 14). What are NFTs. How do you make money out of Them. The Economic Times. https://economictimes.indiatimes.com/news/how-to/what-are-nfts-how-do-you-make-money-out-of-them/what-are-nfts/slideshow/86198170.cms

Ethereum. (n. d.). Non-fungible tokens (NFT). https://ethereum.org/en/nft/

Fintelics. (2021, June 10). How to make money with NFTs - Fintelics. https://fintelics.medium.com/how-to-make-money-with-nfts-15a1e4718d15

Frankenfield, J. (2021, July 25). Ethereum. https://www.investopedia.com/terms/e/ethereum.asp

Frankenfield, J. (2021, August 9). Cryptocurrency. Investopedia. https://www.investopedia.com/terms/c/cryptocurrency.asp

Gedeon, K. (2021, August 11). How to buy NFTs — the easiest way to get non-fungible tokens. https://www.laptopmag.com/how-to/how-to-buy-an-nft-the-easiest-way-to-get-a-non-fungible-token

Gorriceta, A. M. (2021, October 7). New Frontier: NFTs and its legal impact on digital asset regulations. The Manila Times. https://www.manilatimes.net/2021/10/08/business/top-business/new-frontier-nfts-and-its-legal-impact-on-digital-asset-regulations/1817507

Nova, A. (2021, October 16). What are NFTs? Here’s what you need to know about non-fungible tokens. https://www.cnbc.com/2021/10/16/what-are-nfts-heres-what-you-need-to-know-about-non-fungible-tokens.html

Srivastava, P. (2021, August 7). 5 Ways you can make money with Non-Fungible tokens (NFTs). StartupTalky. https://startuptalky.com/making-money-with-nft/

Tretina, K. (2021, July 27). How to Buy Ethereum. https://www.forbes.com/advisor/investing/how-to-buy-ethereum/

Van Boom, D. (2021, March 22). NFT bubble: The craziest nonfungible token sales so far. https://www.cnet.com/news/nft-bubble-the-craziest-nonfungible-token-sales-so-far/

Comments